Saturday, November 12, 2011

Bring back All of Glass-Steagall!

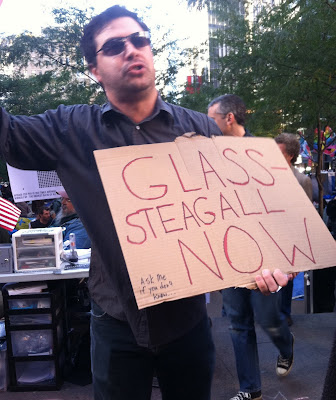

Signs at Occupy Wall Street demonstrations around the nation often call for the reinstatement of the Glass-Steagall Act. They want commercial banks to stop acting like investment banks and hedge funds. Only part of Glass-Steagall was repealed by Congress in 1999, but it was an important part - the provision that kept commercial banks out of investment banking and investment banks out of commercial banking. Commercial banks take deposits and issue loans; investment banks issue bets, more commonly known as stocks, bonds, derivatives and other financial products.

Just what is the Glass-Steagall Act? Glass-Steagall is also known as the Banking Act of 1933, it was the second of two laws passed during the Great Depression to strengthen the economy by creating the Federal Deposit Insurance Corporation, setting limits on bank speculation, and banning commercial banks that accept FDIC-insured deposits from owning investment banks that issue securities and make money through speculation.

Glass-Steagall also prohibited investment bankers from acting as officers from commercial banks. A commercial bank is supposed to be a safe place for money. An investment banker, on the other hand, gets bonuses by maximizing profits-- and the way to do that is to take the biggest, riskiest bets possible. The fat deposits sitting in commercial banks tantalized investment bankers. They looted the commercial banks in the 1920s until Glass-Steagall went into effect.

Glass-Steagall worked. The commercial banks grew sound, jobs rebounded, the middle class boomed and the country grew strong. Glass-Steagall created a firewall between high risk investment banks (Wall Street) and low risk commercial banks.

Economists generally agree that the heady speculation of the 1920s led to the crash of 1929 that preceded the Great Depression. (Unless you're a neocon-- in that case you might blame the Great Depression on the shift from a gold standard and blame the Depression's poor for being poor.) For the record, the US went officially on the gold standard in 1900 and muddled off the gold standard in 1934, well after the Depression started.*

Glass-Steagall was instrumental in bringing the country's banks onto firm financial ground.

For decades, strict regulation kept the banking sector sound. But memories fade. By the 1980s, a handful of bankers were clamoring for deregulation. Commercial banks, sitting on mountains of deposits from trusting customers, looked over at the bonuses raked in by their counterparts at investment banks, hedge funds and financial services companies and glowered with envy. The Glass-Steagall Act had kept them on a sound investment course- which led to those mountains of deposits accumulated over decades - but they wanted the higher yields that fast, high-risk trades could yield. Those engaged in the high risk game called themselves market makers. They would "make markets" by lending money when sound investors refused to take the risk. True, they created liquidity, but the market makers (investment banks) did it without using FDIC-backed funds or taxpayer money. Commercial banks decided they wanted a cut of the profits, regardless of the risk to their customers, the institutions themselves, or the economy. The retail and commercial bank executives wanted the kind of bonuses they saw at investment banks. They could afford the lobbyists to change Congress' mind. They argued that banks in foreign countries could own investment banks and commercial banks and insurance companies all at the same time. They argued that Glass-Steagall kept American banks too small to compete on a global scale. Congress came through with the Gramm-Leach-Bliley Act aka The Financial Modernization Act of 1999. The law was proposed by a trifecta of Republicans, passed with a veto-proof majority, and signed by Clinton.

Sen. Phil Gramm of Texas, unsatisfied with this coup against common sense regulation, also pushed for the complete deregulation of derivatives through the Commodities Futures Modernization Act in 2000, also signed by Clinton. That law, which declared the Commodities Futures Trading Commission could NOT regulate derivatives, led directly to the implosion of 2008 when many of these derivatives went belly up. The 2008 implosion was a toxic stew of Mortgage-backed securities (backed by pieces of actual mortgages), credit default swaps that referenced loan performance but were not backed by any assets, and CDOS. Derivatives were extremely high risk securities that relied on fractional lending. They were bets without backing but that came with ironclad obligations.

From what I understand of the bankruptcy code 11 USC 546(e)(f) and (g), even if an investment banking firm files for bankruptcy, the trustee that must pay the creditors with the firm's assets may not avoid (take back for the bankrupt estate) payments on those derivatives for margin payments, repos or swaps - although the trustee can avoid most other types of preferential payments close to the bankruptcy filing (so that creditors get their money back). Derivatives, in a sense, are obligations with little or no value or consideration backing them - except in some cases, a bet that a tranche of high-risk mortgage might be paid on time. Why do these derivative dealers get preferential treatment in bankruptcy? It's as if they wrote the code themselves. The bottom line - the bankruptcy code helps turn assetless bets - derivatives- into ironclad obligations. This is all the more reason for commercial banks to avoid derivatives. But to truly avoid derivatives, commercial banks needs to stop acting like, or owning, or being part of, investment banks. The commercial and investment banks perform two fundamentally different functions in an economy, and their interests are often at odds.

What happened as a result of the repeal of Glass-Steagall. Financial junkies created a derivatives dealer (called Financial Products) and placed in the belly of the nation's largest insurance company (AIG) where it would have NO capitalization requirements, but could sell the right to banks to offload some of their credit risk for their most toxic assets to itself. AIG, one of the richest companies in the world, almost went insolvent over obligations to pay for losses derivatives that no actual backing in value. The people who perpetrated this monstrosity were never punished. AIG's Financial Products unit made a few people insanely rich, but it never produced anything of value - except for giving banks to disguise the high risk loads they were bearing through asset-backed securities. This was the endgame. It was a scam. The best description I've read of it yet is in "All the Devils are Here: The Hidden History of the Financial Crisis" by Bethany McLean and Joe Nocera. AIG could never have created FP as part of itself had Glass-Stegall not been repealed.

We need Glass-Steagall back. We need to separate the functions of market-making and commercial banking. The profits will be lower in the short-term, but profits in a Glass-Steagall governed financial sector will be durable and sustainable over the decades.

I propose we repeal the Gramm-Leach-Bliley Financial Modernization Act of 1999 AND the Commodities Futures Modernization Act of 2000. They were not acts of modernization but of regression into deregulation when regulation was needed most.

How do we do get this done? That's my question to you.

*Some accounts argue that the United States had a bimetallic standard from Colonial Times until 1933 and others claim the gold standard was in place from 1879 to 1933. The US Congressional Research Service in A Brief History of the Gold Standard in the United States, reports that the official gold standard was in place from 1900 to 1934. Prior to the gold standard, US currency was backed by silver from colonial times. Silver was demonetized in 1873 making gold a de facto standard until 1900 and official standard until 1934). Bottom line, the Depression was in full swing long before the United States went off the gold standard.

Subscribe to:

Post Comments (Atom)

8 comments:

I drop a leave a response whenever I appreciate a post on a website or I

have something to valuable to contribute to the conversation.

It is a result of the passion displayed in the post I browsed.

And after this post "Bring back All of Glass-Steagall!".

I was actually moved enough to post a commenta response :-) I actually do have a few questions

for you if it's allright. Is it only me or do some of these comments come across like left by brain dead visitors? :-P And, if you are writing on additional online social sites, I would like to keep up with you. Would you make a list every one of your social pages like your twitter feed, Facebook page or linkedin profile?

Also visit my site ... Genital Warts Treatment

you're truly a just right webmaster. The website loading velocity is amazing. It seems that you're doing any distinctive trick.

Also, The contents are masterwork. you have performed a excellent process in this subject!

Review my web blog weight loss

Saved as a favorite, I love your web site!

My webpage ... cheap iPhone 5 for sale online

This is a topic that's close to my heart... Take care! Exactly where are your contact details though?

Here is my website ... deploy systems

I'm extremely inspired along with your writing abilities and also with the layout to your weblog. Is that this a paid theme or did you modify it yourself? Anyway keep up the excellent quality writing, it is uncommon to see a nice weblog like this one these days..

My weblog ... Smith Mountain Lake

I all the time used to study post in news papers but now as I am a user of internet therefore from now I am using net for content, thanks to

web.

Here is my weblog view map

Hello there! This post couldn't be written any better! Reading through this article reminds me of my previous roommate! He constantly kept talking about this. I'll

send this information to him. Fairly certain he's going to have a great read. Many thanks for sharing!

Here is my weblog; book promotion

Hi! This post could not be written any better!

Reading this post reminds me of my previous room mate!

He always kept talking about this. I will forward this article to him.

Fairly certain he will have a good read. Thank you for sharing!

Also visit my blog: Free Compilation xxx

Post a Comment